The Feie Calculator Ideas

Table of ContentsSome Known Factual Statements About Feie Calculator Examine This Report about Feie CalculatorFascination About Feie CalculatorFeie Calculator Things To Know Before You Get ThisSome Of Feie Calculator

US expats aren't restricted only to expat-specific tax obligation breaks. Typically, they can assert a number of the same tax obligation credit scores and reductions as they would in the United States, including the Kid Tax Credit (CTC) and the Lifetime Learning Credit Scores (LLC). It's feasible for the FEIE to reduce your AGI a lot that you don't get specific tax obligation debts, however, so you'll need to ascertain your qualification.

The tax code says that if you're a united state citizen or a resident alien of the United States and you live abroad, the internal revenue service taxes your globally income. You make it, they tire it no issue where you make it. Yet you do obtain a good exclusion for tax year 2024.

For 2024, the optimal exclusion has been raised to $126,500. There is additionally an amount of qualified housing expenses eligible for exclusion.

The Only Guide to Feie Calculator

You'll have to figure the exemption first, because it's limited to your international earned earnings minus any type of foreign housing exclusion you assert. To certify for the international gained income exemption, the foreign housing exclusion or the foreign housing deduction, your tax obligation home need to be in an international nation, and you should be just one of the following: An authentic citizen of a foreign nation for an undisturbed period that includes a whole tax year (Bona Fide Resident Test).

for at the very least 330 complete days throughout any period of 12 successive months (Physical Visibility Test). The Authentic Citizen Test is not suitable to nonresident aliens. If you declare to the foreign government that you are not a citizen, the test is not pleased. Qualification for the exemption can likewise be affected by some tax obligation treaties.

For united state people living abroad or gaining earnings from international sources, questions commonly emerge on just how the united state tax system puts on them and just how they can make certain compliance while minimizing tax obligation obligation. From comprehending what international earnings is to browsing numerous tax obligation types and reductions, it is necessary for accountants to recognize the ins and outs of U.S.

Dive to Foreign earnings is defined as any type of income earned from resources outside of the USA. It encompasses a vast array of monetary tasks, including but not limited to: Incomes and wages gained while working abroad Incentives, allocations, and advantages supplied by foreign companies Self-employment income stemmed from international services Passion earned from international bank accounts or bonds Dividends from foreign corporations Resources gains More Info from the sale of foreign possessions, such as real estate or supplies Revenues from leasing international residential properties Income created by international companies or collaborations in which you have an interest Any other income earned from foreign resources, such as nobilities, spousal support, or wagering jackpots Foreign earned revenue is defined as revenue gained via labor or services while living and functioning in an international country.

It's essential to identify foreign earned revenue from various other sorts of foreign earnings, as the Foreign Earned Income Exclusion (FEIE), a useful united state tax obligation advantage, particularly relates to this classification. Financial investment earnings, rental income, and passive earnings from international resources do not receive the FEIE - Form 2555. These kinds of revenue may go through different tax obligation therapy

resident alien who is a person or nationwide of a nation with which the United States has a revenue tax obligation treaty effectively and that is a bona fide resident of an international nation or countries for an undisturbed period that consists of an entire tax year, or A united state resident or a UNITED STATE

Feie Calculator Can Be Fun For Anyone

Foreign made earnings. You need to have earned income from employment or self-employment in an international nation. Passive revenue, such as rate of interest, rewards, and rental income, does not get approved for the FEIE. Tax home. You have to have a tax home in a foreign nation. Your tax obligation home is typically the area where you conduct your routine organization activities and keep your key economic passions.

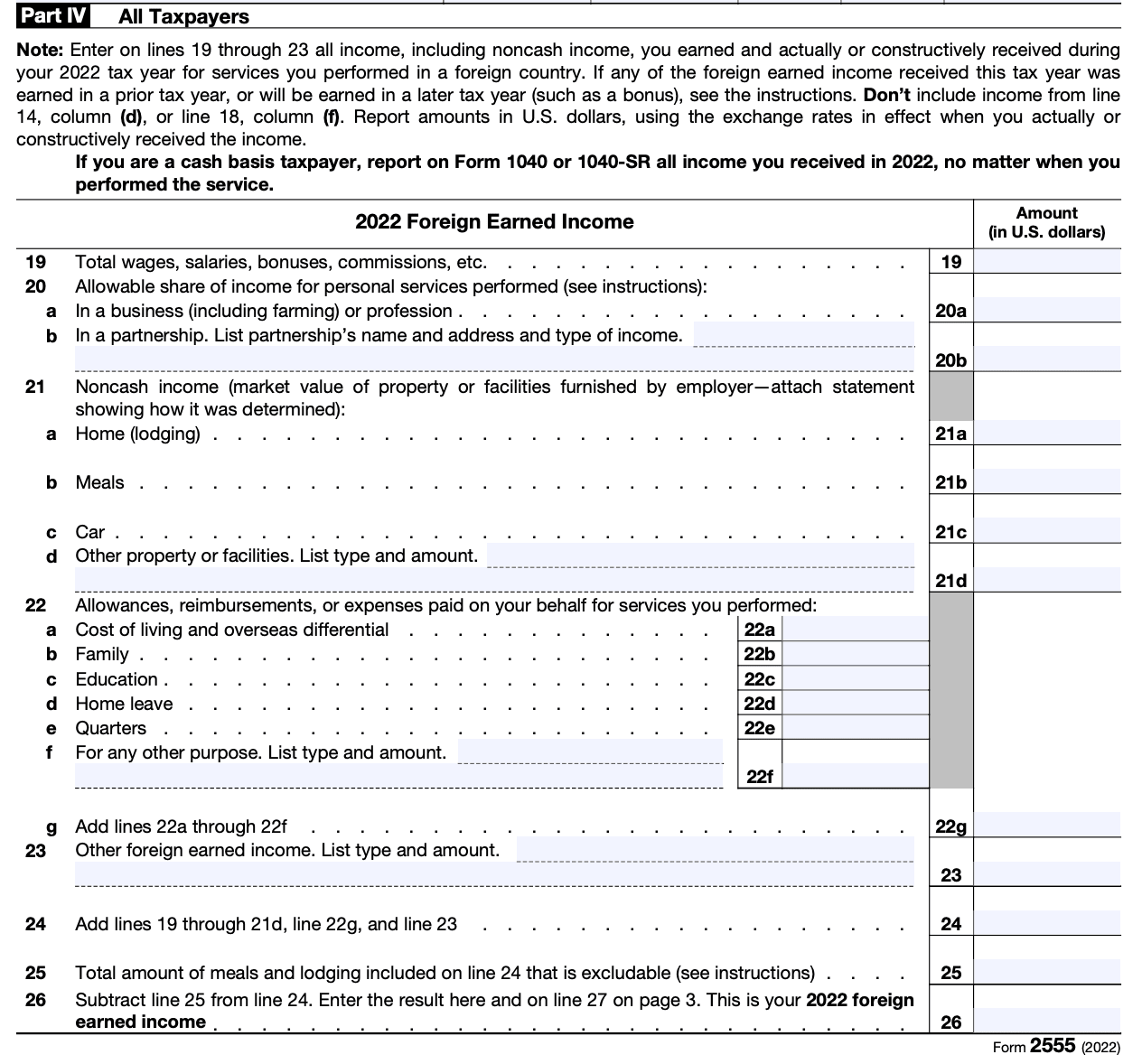

income tax return for international revenue tax obligations paid to an international federal government. This debt can counter your united state tax obligation obligation on foreign revenue that is not qualified for the FEIE, such as financial investment earnings or passive revenue. To assert these, you'll initially have to qualify (Digital Nomad). If you do, you'll after that submit extra tax return (Type 2555 for the FEIE and Form 1116 for the FTC) and affix them to Kind 1040.

The Buzz on Feie Calculator

The Foreign Earned Revenue Exclusion (FEIE) enables eligible people to omit a section of their international made revenue from united state taxation. This exemption can substantially lower or eliminate the united state tax liability on international revenue. The particular amount of foreign earnings that is tax-free in the U.S. under the FEIE can alter every year due to inflation changes.

Comments on “3 Easy Facts About Feie Calculator Shown”